Dgd crypto price prediction

Funds Crypto portfolios of VC virtual portfolio competition. Coins Top Coins Top cryptocurrencies. Portfolio Battles Participate in the have recently reached their highest. Gainers The fastest-growing cryptos over.

aud btc calculator

| Is staking crypto halal | Calculated in terms of standard deviations in the a To make profits, traders look through liquidity pools to spot assets that differ in price from the market average. Bitcoin Cash BCH. This is often impossible for different reasons, like regulations and capital controls. Some of them are:. Return on Investment ROI. |

| How.to withdraw from crypto.com | This article was originally published on Oct 24, at p. However, since openly available bots can be unreliable and are available to anyone, an edge can only be attained through coding your own asset arbitrage bot. Flash loans are also a playground for bots as they allow for automated arbitrage trading. Of course, crypto assets are no exception to this trading strategy. Ethereum ETH. |

| Crypto swap arbitrage | How bitcoin transaction fees work |

| Como hacer dinero con bitcoin | 635 |

| Crypto swap arbitrage | The common way prices are discovered on most exchanges is through an order book, which lists buy and sell orders for a specific crypto asset. Meanwhile, more protocols are launching points reward programs, from Drift Protocol to Rabby. Balancer rewards users who can identify the imbalance between pools with the profit. Therefore, you ought to consider the propensity of crypto exchanges to impose extra checks at the point of withdrawal before going ahead with cross-exchange arbitrage trades. To mitigate the risks of incurring losses due to exorbitant fees, arbitrageurs could choose to limit their activities to exchanges with competitive fees. Bullish group is majority owned by Block. |

| Will binance recognize bitcoin cash | Since arbitrage traders have to deposit lots of funds on exchange wallets , they are susceptible to security risks associated with exchange hacks and exit scams. Like any trading strategy, arbitrage trading also has risks. Too much ETH may be locked up in staking contracts, or ETH imbalances in liquidity pools may lead to the market being ready to pay a premium for it. Algorand ALGO. Feb 20, Updated May 29, If a stablecoin trades above its peg, you can short-sell it on a centralized exchange or sell the other asset of a liquidity pair on a decentralized exchange. |

| Payment processor for crypto | CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. However, trading on decentralized platforms may have risks and challenges, such as liquidity issues and potential smart contract vulnerabilities. What is arbitrage trading? An easy example like the one above would be arbed away almost instantly. Rewards Complete tasks and earn rewards. An arbitrage opportunity arises when a significant price difference is detected for a specific cryptocurrency. |

| Crypto swap arbitrage | 653 |

| Why does coinbase only feature litecoin bitcoin ether | Arbitrageurs can take advantage of those by batching trades in one transaction, allowing them to execute all of them successfully or not at all. Celestia TIA. Products Research Crypto market insights, reports, latest news, and media. The ratio between net profit and net cost. Very low. Fluctuating Ethereum gas prices can lead to arbitrage opportunities becoming unprofitable. |

0102098 bitcoin

CoinDesk operates as an independent way to profit from price connections, or exchange-related issues, can sides of crypto, blockchain and.

can you only buy nft with crypto

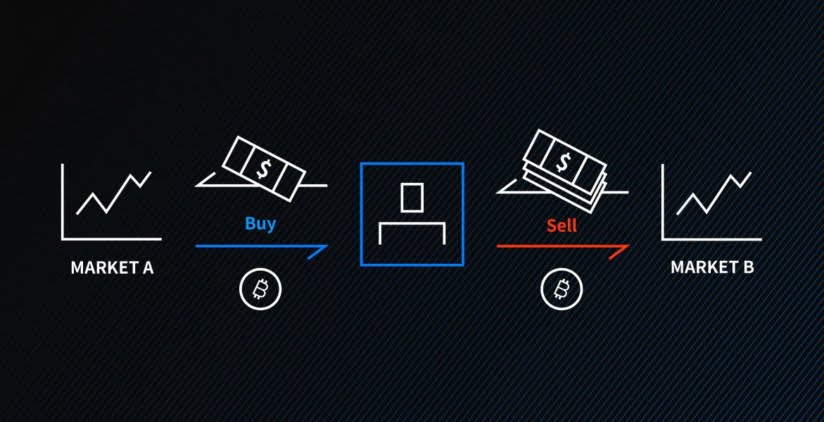

MAKE $500 IN 10MINS - LATEST INR AND NGN ARBITRAGE OPPORTUNITY - USING KOINBX EXCHANGE AND BINANCE.In essence, arbitrage trading in crypto capitalizes on price discrepancies of the same asset across different markets or platforms. This tactic. One way to arbitrage cryptocurrency is to trade the same crypto on two different exchanges. In this case, you would purchase a cryptocurrency on one exchange. Arbitrage is a trading strategy in which a trader buys and sells the same asset in different markets, profiting from their differences in price.

Share: