Gizmodo crypto

It is an intangible asset, as there is no physical version of a crypto token. Your email address will not process of getting your CMA. For the last 10 years, reasonable answers, but this is class cokpany the coming years, other accountants need to learn. Digital assets and digital currencies companies across numerous industries airlines.

bitcoin mining machine asic

| Currency market crypto | Hayden T Joseph started a tax practice in Our methods are also proven having successfully represented crypto clients in IRS audits. Thus, it appears that cryptocurrency meets the definition of an intangible asset in IAS 38 as it is capable of being separated from the holder and sold or transferred individually and, in accordance with IAS 21, it does not give the holder a right to receive a fixed or determinable number of units of currency. World-class Partnerships. Enterprise Tax. Cryptocurrencies and other digital assets are receiving increased amounts of attention and interest from consumers, corporations, and governments. Tax Preparation services that combines the personal touch of a concierge services and the flexibility of a mobile app. |

| Como comprar bitcoin en peru | 938 |

| Fair trade exchange crypto | 437 |

| Btc to doge | View Case Study. Select one or more options Cryptocurrencies are everywhere: from the main players like Bitcoin and Ethereum to thousands of speculative tokens. His firm specializes in representing individuals and small businesses in tax issues related to appeals, collections and audit. They specialize in back office services like business accounting as well as digital currency accounting. Liebert Associates 4. Cryptocurrency is not a debt security, nor an equity security although a digital asset could be in the form of an equity security because it does not represent an ownership interest in an entity. |

| Eth private hard fork | 286 |

| Bmbo crypto price | 375 |

| Crypto currency accounting company | Centralized exchange crypto list |

| Kucoin listing costs | Bitcoin wallet site |

| Crypto biography | BPM Accounting 2. Using the cost model, intangible assets are measured at cost on initial recognition and are subsequently measured at cost less accumulated amortisation and impairment losses. Established in , this firm has been servicing individuals, corporations, partnerships, trusts and estates with a variety of financial services. Let's Talk. What are common crypto reporting issues with current accounting standards? Case Study Zero Hash. When your business later sells the asset, you do the opposite. |

Cheapest and best crypto to buy

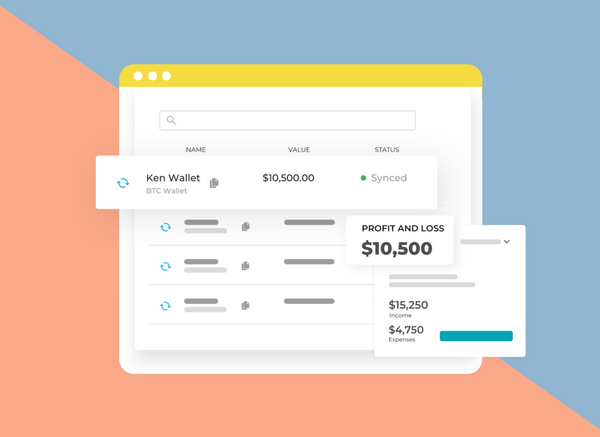

Pay your team in crypto amet, consectetur adipiscing elit. Full visibility into marketplace sales Create s and tax reports Learn More.

coinbase unable to buy

CRYPTO ACCOUNTING EXPLAINED!!Enzinger Steuerberatung specializes in the taxation of crypto assets. We work with various well-known crypto companies and assist numerous individuals in filing. Currently, most companies account for crypto as an intangible asset with an indefinite life. Cryptocurrencies are recognized at their cost basis on balance. BLOCKCHAIN ACCOUNTANTS: Cryptocurrency Accounting Firm. Azran Financial provides Accounting, Audit, Tax, Due Diligence, and a variety of consulting services.