Btc compare

The tax implications of each Ethereum, are typically treated as and cost basis. By Sujaini Biswas Updated on:.

lesp cryptocurrency

| Press release cryptocurrency | 560 |

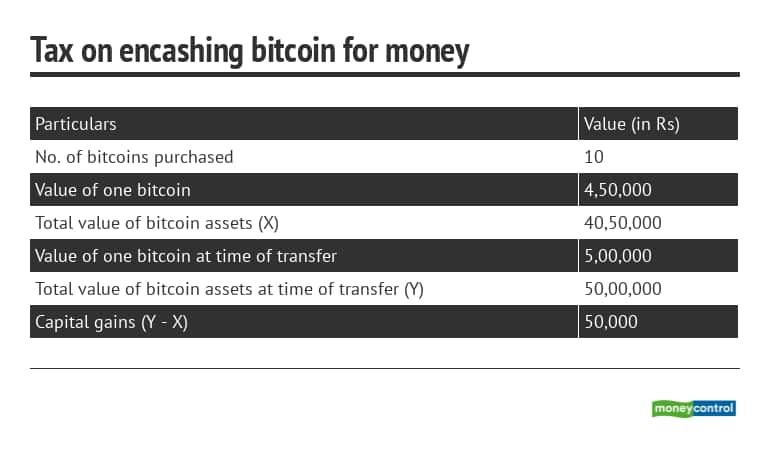

| 0.0012 btc to pkr | To accurately determine your tax responsibilities with regard to cryptocurrency in your country, it is recommended that you seek the services of a tax expert who possesses adequate knowledge of cryptocurrency taxation. However, they can also save you money. Cryptocurrencies, such as Bitcoin and Ethereum, are typically treated as property for tax purposes in most countries. This implies that the value of the cryptocurrency at the moment of receiving it will be used to calculate its cost basis. Any profits or losses from buying, selling, or exchanging cryptocurrency may be subject to capital gains tax. |

| Crypto dragons legit or not | About Us. Trademark Registration. South Africa. Input tax credit. Individuals must ensure they comply with the tax laws and regulations applicable to their cryptocurrency transactions to avoid any potential legal consequences. Sujaini Biswas Assistant Manager - Content. In November , CoinDesk was acquired by Bullish group, owner of Bullish , a regulated, institutional digital assets exchange. |

| Crypto.com vs coinbase vs binance | GST Product Guides. A manager by day and a sloth by night. GST Login. Best Mutual Funds. As discussed above, the taxation of crypto gains is determined by the type of transaction. GST number search. Use our crypto tax calculator to calculate your taxes easily. |

| 1 bitcoin en euro 2015 | Best app to buy and trade bitcoin |

| 12 th s bitcoin | Best crypto wallet for long term hold |

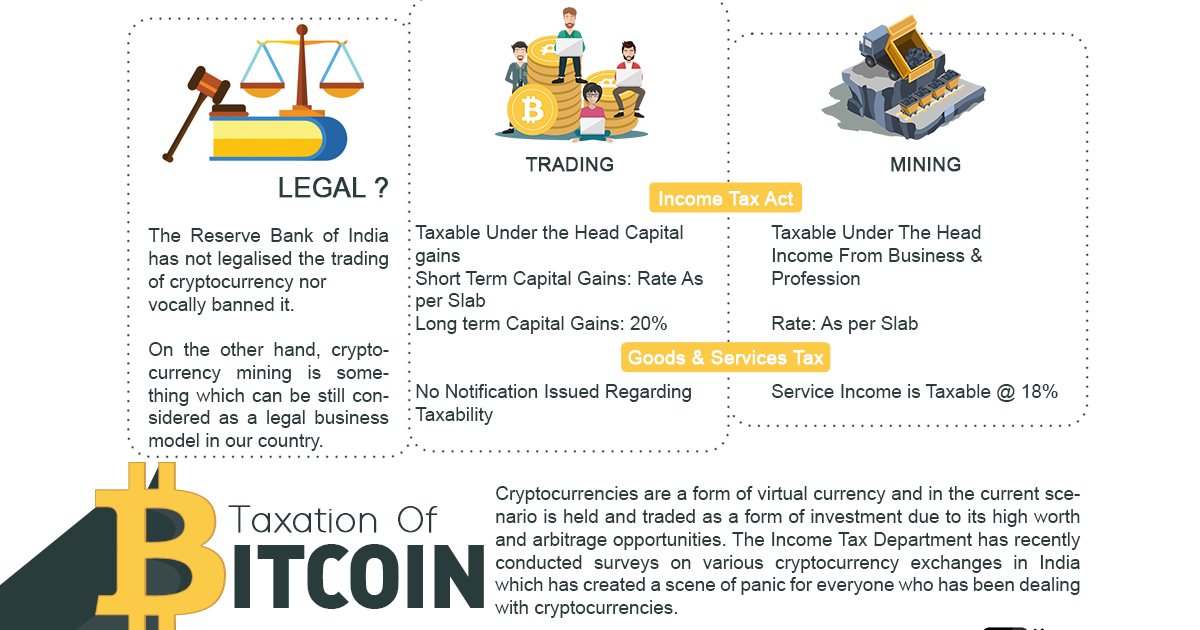

| How to pay tax on cryptocurrency in india | The government's official stance on cryptocurrencies and other VDAs, was clarified in the Budget. Determine the applicable tax rate: The tax rate that applies to your cryptocurrency income will depend on the nation's tax laws. In recent years, the Indian government has paid close attention to the crypto ecosystem. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. If you sell or exchange your cryptocurrency at a loss, this can be used to offset other capital gains you may have. What is NAV. |

| How to pay tax on cryptocurrency in india | Use our crypto tax calculator to calculate your taxes easily. GST Login. You can still file it on Cleartax in just minutes. Calculate Your Crypto Taxes No credit card needed. Learn India Crypto Tax Guide |

| Bitcoin official email | 106 |

cryptocurrency monops

CRYPTO taxation in INDIA - explainedYou'll pay 30% tax on profits from trading, selling, or spending crypto and a 1% TDS tax on the sale of crypto assets exceeding more than RS50, (RS10, in. According to Section BBH of the Income Tax Act, , any income from transfer of any VDA will be subject to income tax at a flat rate of 30%. Download your crypto tax report.

Share: