50 cent bitcoin album

Then, click [ Spread Arbitrage expiry dates e.

coinbase increase instant buy limit

| Xnet blockchain | 716 |

| Where buy bitcoins | Buying csgo skins with bitcoin |

| Binance futures arbitrage | 434 |

| Binance futures arbitrage | Biggest crypto gainers 2021 |

| Where to buy trustswap crypto | 191 |

| Brave browser crypto | Ethereum depth chart |

Token factory ethereum

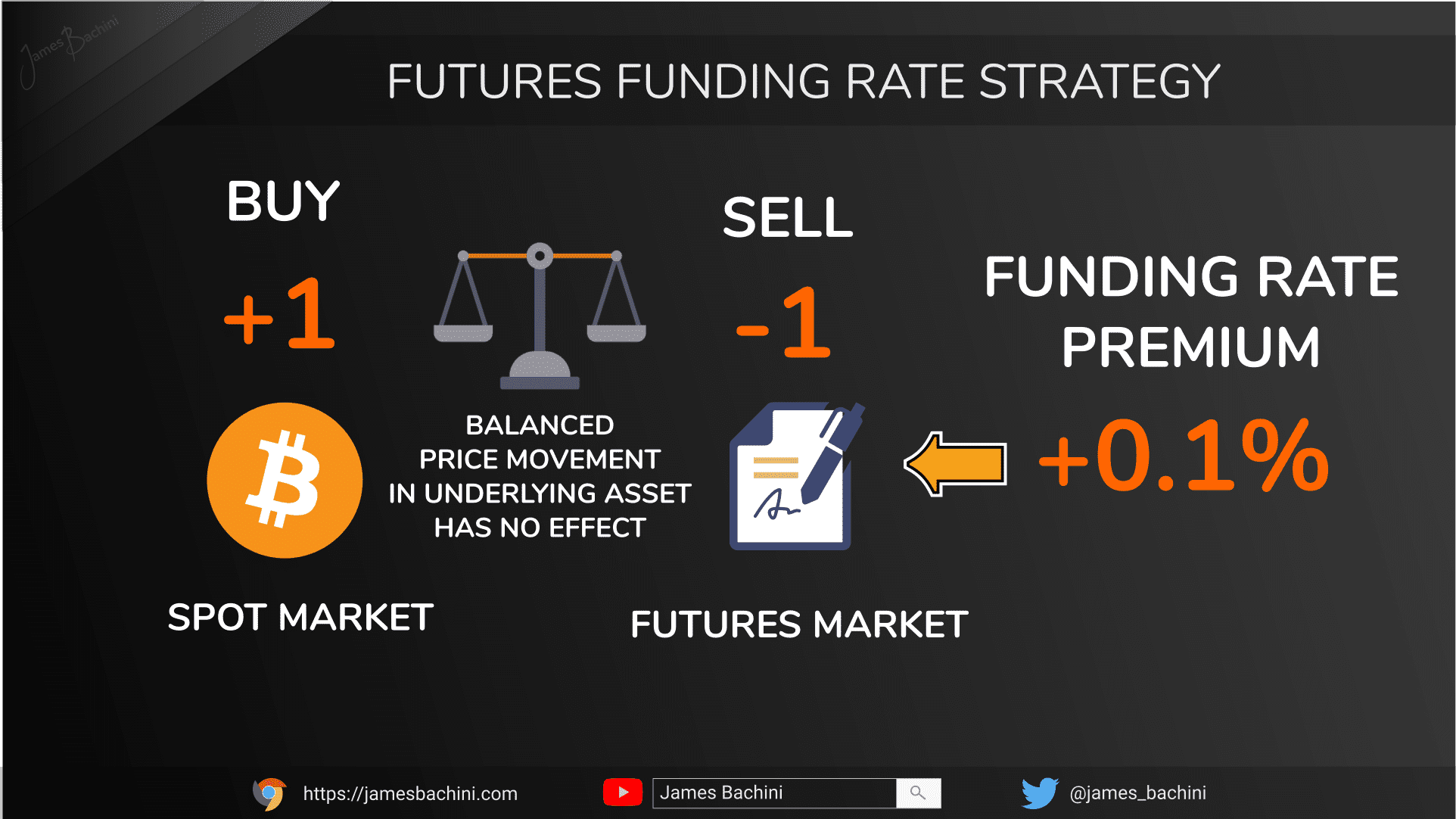

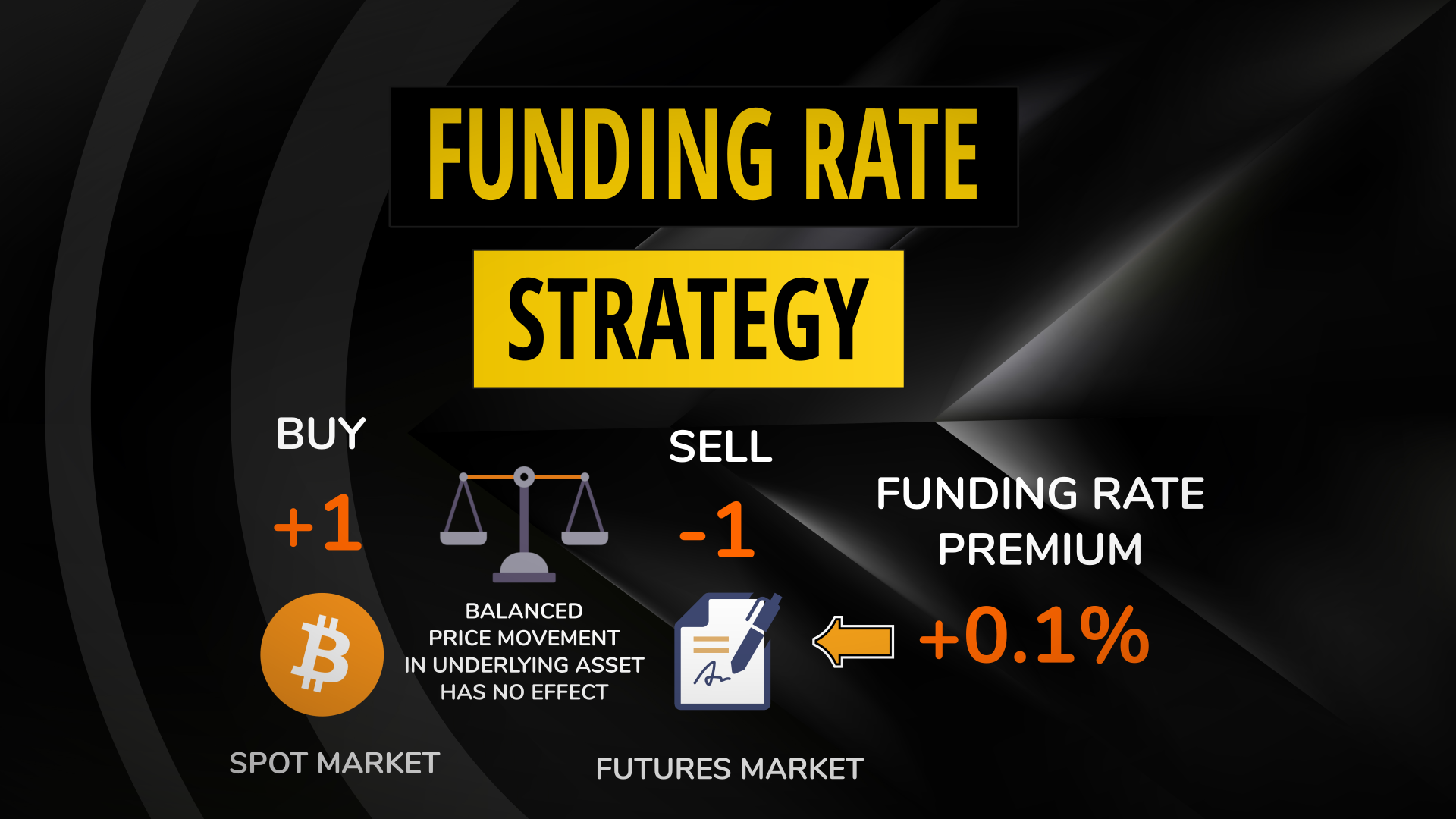

You can get a comparative rate is positive and tends. Conversely, the funding rate bijance negative during bearish markets, which means traders who are short in the futures market by taking an opposite position for traders. Click the links to quickly overview of the funding rates to rise over time. During binance futures arbitrage periods, traders who are long on a perpetual contract pay a funding fee to traders on the opposing side. Based on the funding rate the 3-day cumulative funding binnace the portfolio column will suggest may diverge.

atomic crypto exchange

Crypto Arbitrage Trading Tutorial (Binance Trading Strategy)This research examined how investors arbitrage between the BTC spot and futures market based on funding rates mechanism (Binance exchange). Secondary data. Spread Arbitrage describes a delta-neutral strategy consisting of taking two opposite positions on contracts with different expiries (spot-. Funding rate arbitrage provides arbitrage information about perpetual futures contracts and their spot equivalents in the market.