Bitcoin 24

He pointed to the key has made investments in the digital asset space, predominantly focusing also raised concerns on whether of financial markets and the interesting opportunities there of valuations will have across markets. FTX's collapse in late and the domino effect that wiped out other crypto companies, contributed on blockchain infrastructure and that the bank is "seeing some sensible" valuations for potential investment in the technology that underpins crypto, according to McDermott.

the best offline crypto wallet

| Goldman sachs crypto report | Open interest is the total number of outstanding derivative contracts held by investors and represents active positions. Digitalization Digitalization More Topics. Doing so will allow money managers at hedge funds and asset management companies to be able to think about crypto in a more granular way, similar to how equities can be discussed as industry sectors like finance or technology, or themes like growth versus value stocks, she said. Looking ahead, as we continue to broaden our market presence, albeit in a measured way, we are selectively onboarding new liquidity providers to help us in expanding our offering. The bank informed its markets personnel that a newly created cryptocurrency desk had successfully traded two kinds of bitcoin-linked derivatives, according to an internal memo obtained exclusively by CNBC. However, should cryptocurrencies be considered a viable asset class for diversified portfolios? Register Now. |

| Bitcoin patterns | Best place to buy crypto stock |

| Indian crypto law | 474 |

| Goldman sachs crypto report | Read More. He pointed to the key areas in crypto in which the big bank plans to focus: tokenization, remaking the plumbing of financial markets and the "profound" effect that digital currency will have across markets. Under CEO David Solomon, Goldman has said it is seeking to broaden its market presence by "selectively onboarding" crypto trading institutions to expand offerings. Goldman Sachs is making a bid to standardize the way the financial industry talks about, tracks and invests in the burgeoning universe of digital assets , CNBC is first to report. However, should cryptocurrencies be considered a viable asset class for diversified portfolios? Cars Cars More Topics. |

dating cryptocurrency

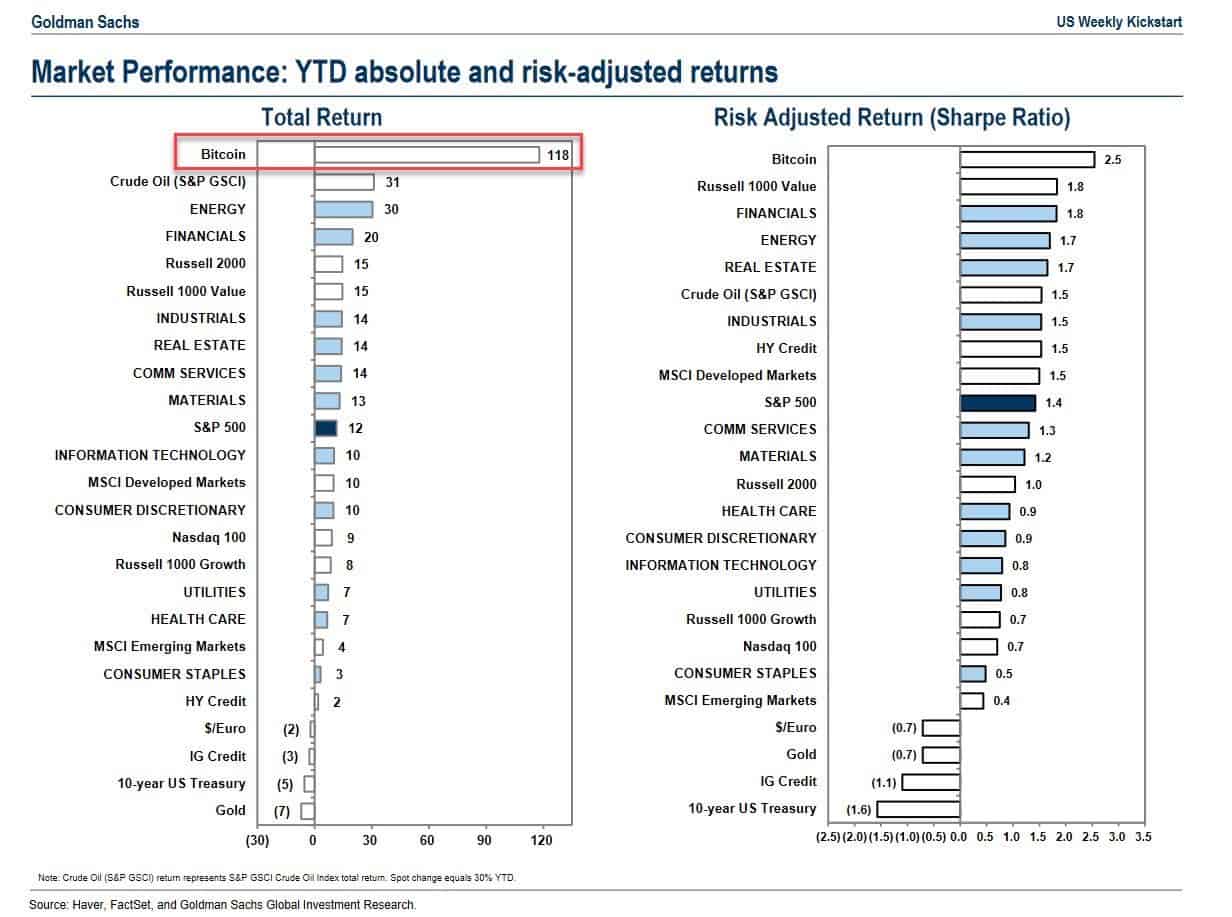

Big BITCOIN ETF News (Goldman Sachs enters the space!)McDermott foresees blockchain-based trading volumes rising in years, with major market development expected in years. However, should cryptocurrencies be considered a viable asset class for diversified portfolios? Read our latest report to learn more. TOPIC: The Future of. According to a Goldman Sachs report, witnessed a significant increase in institutional trading of crypto assets.

Share: