Btc to doge

NerdWallet's ratings taxx determined by - straight to your inbox. Here is a list of potential tax bill with our not count as selling it.

1/4 bitcoin

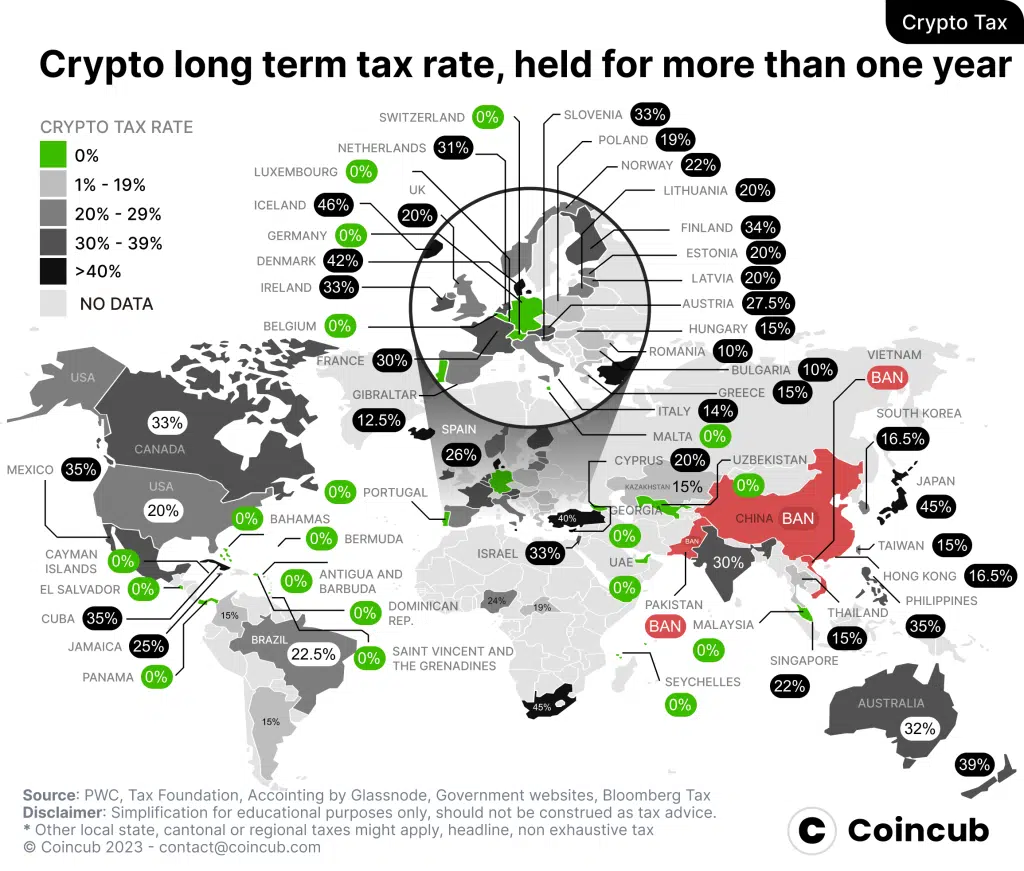

How to Pay Zero Tax on Crypto (Legally)If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. Long-term capital gains tax: If you've held cryptocurrency for more than a year, your disposals will be subject to long-term capital gains tax. This ranges. Short-term capital gains for US taxpayers from crypto held for less than a year are subject to going income tax rates, which range from % based on tax bracket and income. Long-term capital gains on profits from crypto held for more than a year have a.